Medical Insurance: Highmark Blue Cross Blue Shield of Delaware

The City of Wilmington offers medical insurance through Highmark Blue Cross Blue Shield of Delaware. The below chart is a brief outline of the plan options.

Highmark Customer Service: 1-844-946-6259

Highmark website: www.highmarkbcbsde.com

Highmark mobile app: download the Highmark app to access your and your covered dependents’ medical cards and claims.

Transparency in Coverage website: https://mrfdata.hmhs.com/

There is an opportunity to receive a 2% discount on your medical premium each year. To learn more about our Wellness Discount Program CLICK HERE

Check out your Blue 365 Deals: Home Page | Blue365 Deals

Which Medical Plan is Right?

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

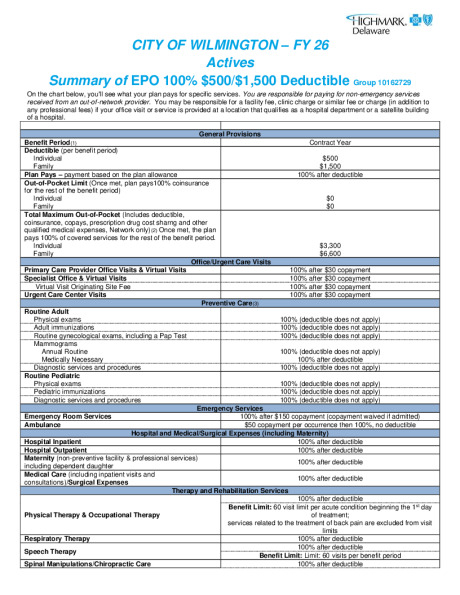

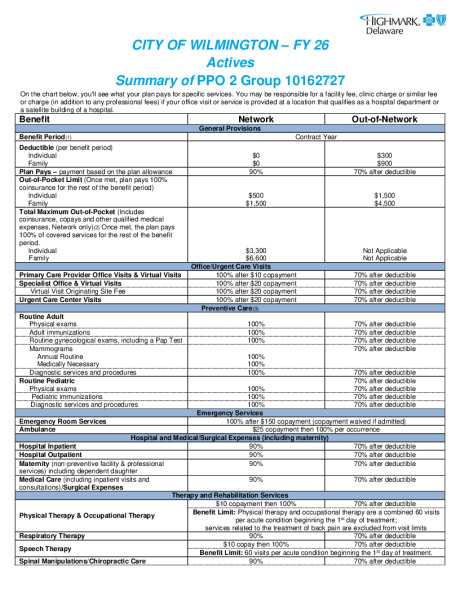

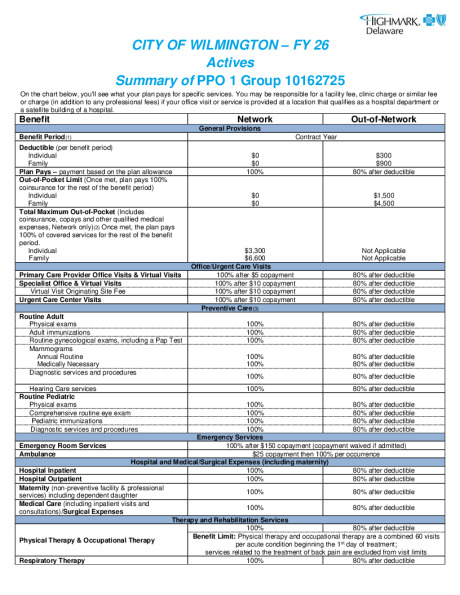

Medical Plan Comparison

| | Highmark Blue Cross Blue Shield PPO Plan 1 |

Highmark Blue Cross Blue Shield PPO Plan 2 |

Highmark Blue Cross Blue Shield EPO Plan |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| PPO In-Network | PPO Out-of-Network | PPO In-Network | PPO Out-of-Network | Schedule of Benefits | ||||||

| Annual Deductible | ||||||||||

| Individual | $0 | $300 | $0 | $300 | $500 | |||||

| Family | $0 | $900 | $0 | $900 | $1,500 | |||||

| Coinsurance | 100% | 80% | 90% | 70% | 100% | |||||

| Total Maximum Out-of-Pocket | ||||||||||

| Individual | $3,300 | N/A | $3,300 | N/A | $3,300 | |||||

| Family | $6,600 | N/A | $6,600 | N/A | $6,600 | |||||

| Physician Office Visit | ||||||||||

| Primary Care | 100% after $5 copay | 80% after deductible | 100% after $10 copay | 70% after deductible | 100% after $30 copay | |||||

| Specialty Care | 100% after $10 copay | 80% after deductible | 100% after $20 copay | 70% after deductible | 100% after $30 copay | |||||

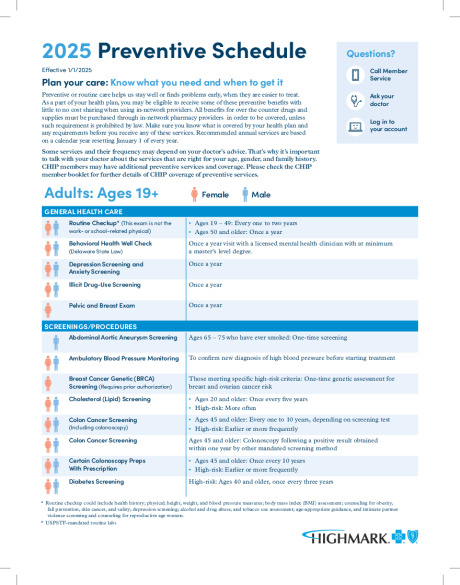

| Preventive Care | ||||||||||

| Adult/Well-Child Preventive | 100% | 80% after deductible | 100% | 70% after deductible | 100% | |||||

| Diagnostic Services | ||||||||||

| X-ray and Lab Tests | 100% after deductible | 80% after deductible | 90% after deductible | 70% after deductible | 100% after deductible | |||||

| Complex Radiology | 100% after deductible | 80% after deductible | 90% after deductible | 70% after deductible | 100% after deductible | |||||

| Urgent Care Facility | 100% after $10 copay | 80% after deductible | 100% after $20 copay | 70% after deductible | 100% after $30 copay | |||||

| Emergency Room Facility Charges | 100% after $150 copay waived if admitted | 100% after $150 copay waived if admitted | 100% after $50 copay; waived if admitted | 100% after $50 copay; waived if admitted | 100% after $150 copay; waived if admitted | |||||

| Inpatient/Outpatient Facility & Surgical Charges | 100% after deductible | 80% after deductible | 90% after deductible | 70% after deductible | 100% after deductible | |||||

| Mental Health/Substance Health | ||||||||||

| Inpatient | 100% after deductible | 80% after deductible | 90% after deductible | 70% after deductible | 100% after deductible | |||||

| Outpatient | 100% after deductible | 80% after deductible | 100% after $10 copay | 70% after deductible | 100% after $30 copay | |||||

| Retail Pharmacy (30 Day Supply) | ||||||||||

| Generic | $10 copay | Not covered | $10 copay | Not covered | $10 copay | |||||

| Preferred | $20 copay | Not covered | $20 copay | Not covered | $20 copay | |||||

| Non-Preferred | $35 copay | Not covered | $35 copay | Not covered | $35 copay | |||||

| Mail Order Pharmacy (90 Day Supply) | ||||||||||

| Generic | $20 copay | Not covered | $20 copay | Not covered | $20 copay | |||||

| Preferred | $40 copay | Not covered | $40 copay | Not covered | $40 copay | |||||

| Non-Preferred | $70 copay | Not covered | $70 copay | Not covered | $70 copay | |||||

Note: Please consult plan documents for full benefits, exclusions, and limitations.

Clarity 360

Clarity 360: Highmark

Personalized support to help you:

- Make important care decisions and ensure

you receive the highest quality of care. - Manage a health condition.

- Improve lifestyle habits.

- Reduce risk for chronic diseases like diabetes

or heart disease. - Get preventive care.

- Get answers to your health and coverage

questions and more.

- Make important care decisions and ensure