Flexible Spending Accounts (FSAs)

The City of Wilmington partners with Flex Facts to provide employees with several benefit options designed to help you save money on everyday expenses. The available plans include:

- Medical Flexible Spending Account (FSA)

- Dependent Care Flexible Spending Account (FSA)

- Parking Flexible Spending Account

- Transit Flexible Spending Account

To learn more about each of these programs, please see the detailed information below.

Customer Service: 1-877-943-2287 or www.flexfacts.com

Grant Benefit Solutions mobile app: download the Grant Benefit Solutions app to manage your account/s and check balances.

Medical FSA & Dependent Care FSA

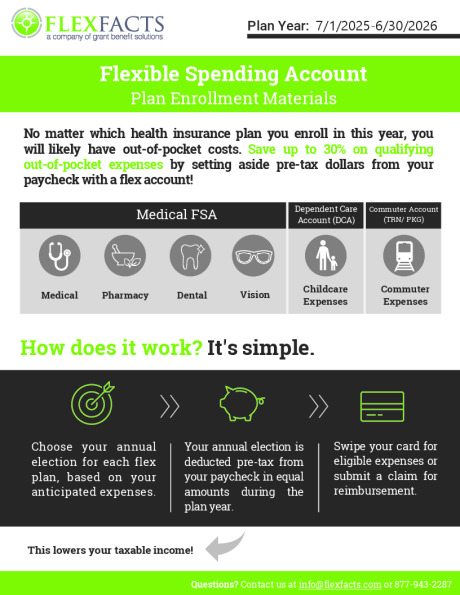

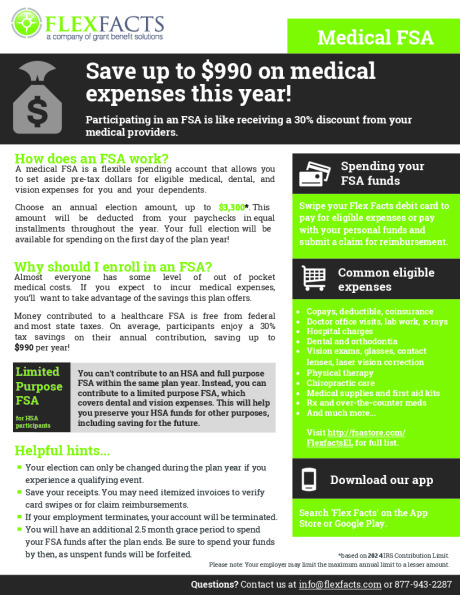

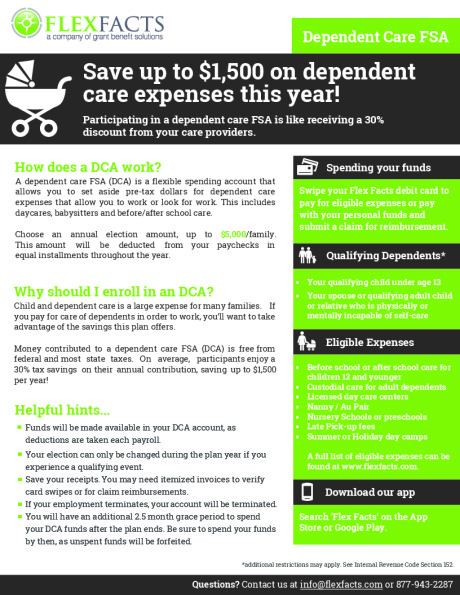

Medical and Dependent Care Flexible Spending Accounts (FSAs) offer a valuable tax advantage by allowing you to set aside pre-tax dollars from your paycheck to cover eligible out-of-pocket medical and dependent care expenses.

By planning ahead for these costs each year, you can reduce your taxable income and save money on essential expenses. There are two types of FSAs you can elect:

Medical FSA – For qualifying healthcare expenses not covered by insurance.

Dependent Care FSA – For eligible child and dependent care expenses.

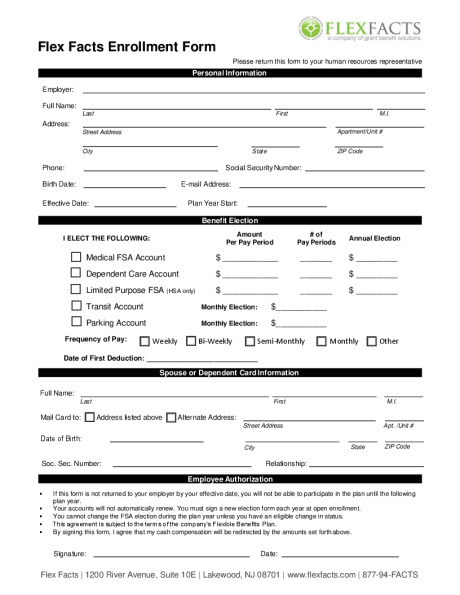

Once enrolled, you’ll choose an annual contribution amount, which is deducted from your paycheck throughout the year before taxes are applied. You can then use those funds to pay for approved expenses as outlined by the IRS.

Important Notes:

You must choose your contribution amount at the start of the plan year.

Changes are only allowed if you experience a qualifying life event (such as marriage, birth of a child, etc.).

FSAs are subject to the IRS “use-it-or-lose-it” rule—any unused funds at year-end may be forfeited.

For a full list of eligible expenses, go to healthequity.com/qme

For online shopping with your FSA card you can visit fsastore.com or amazon.com

Parking or Transit

- Reduce taxes

- Rolling Benefits–(may be carried over to next plan year)

- Claims must be within plan year

- Can make change or cancel w/o Family Status Change

- Must be commuter expense for employee transportation to work